Tax On Redundancy Payments Australia

If any of the ETP is tax-free. If you think this may apply to you or for more information Contact us.

Employment Termination Payments Atotaxrates Info

A genuine redundancy payment receives some concessional tax treatment.

Tax on redundancy payments australia. Managing performance. Redundancy and early retirement Genuine redundancy and early retirement scheme payments are tax free up to a limit based on the employees years of service. Employee entitlements - overview.

The following payments are tax free. For the 201819 financial year this limit is 10399 plus 5200 for every completed year of service. Uniforms vehicle.

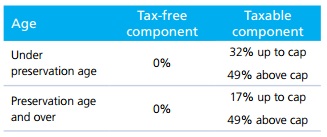

The tax-free amount if the termination is because of a genuine redundancy or early retirement scheme Payments for these types of termination are tax free up to a certain limit. Below the preservation age you pay tax at 30 Medicare Levy on any excess amount above the tax free component up to 210000. Genuine redundancy payments are tax-free up to a limit based on the employees completed years of service with the employer.

A payment that is made in lieu of notice. Tax-free up to a limit based on your years of service concessionally taxed as an employment termination payment ETP above your tax-free limit taxed at your usual marginal tax rate for any amount above certain caps. Work out your tax-free limit You will need to know how long you worked for the employer who made the payment.

Flexibility in the workplace. Based on the current Australian tax rates these are taxed at 32. Notice.

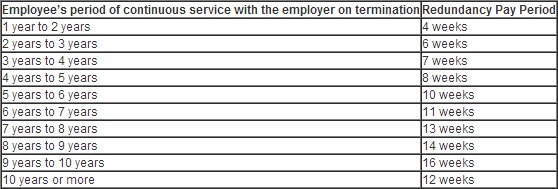

Work out the tax-free limit and complete your 2019-20 tax return. Get help with ending employment. Employees who were made redundant before 31 December 2014 may have been entitled to more generous redundancy pay under an old award.

An employer can apply to the Fair Work Commission to have the amount of redundancy they have to pay reduced if. They are taxed as part of an employees ETP but if the amount does not exceed certain caps the payment is considered taxable income. Your accrued leave holiday leave and long service leave is taxed separately to your redundancy payment.

The base tax-free limit for income year 2020 2021 is 10989. The tax-free amount is not part of the employees ETP. Redundancy payments made to ACIRT members after 12 months from their termination date are not ETPs and are taxed as directed by the Australian Taxation Office.

Hours of work breaks. So if your total genuine redundancy payment is less than this you wont pay any tax on the payment at all. Then an additional 5496 for every year of completed service.

The statutory redundancy lump sum A payment made on account of death injury or disability subject to a maximum lifetime tax-free limit of 200000 Certain payments made by employers to employees arising from employment law rights claims. Non-genuine redundancy payments are not tax-free. Although it receives a lower rate than normal.

Your genuine redundancy payment is. The tax-free amount is not part of the employees ETP. The 201920 tax-free component of a genuine redundancy is 10638 plus 5320 for each complete year of service up to a maximum of 210000.

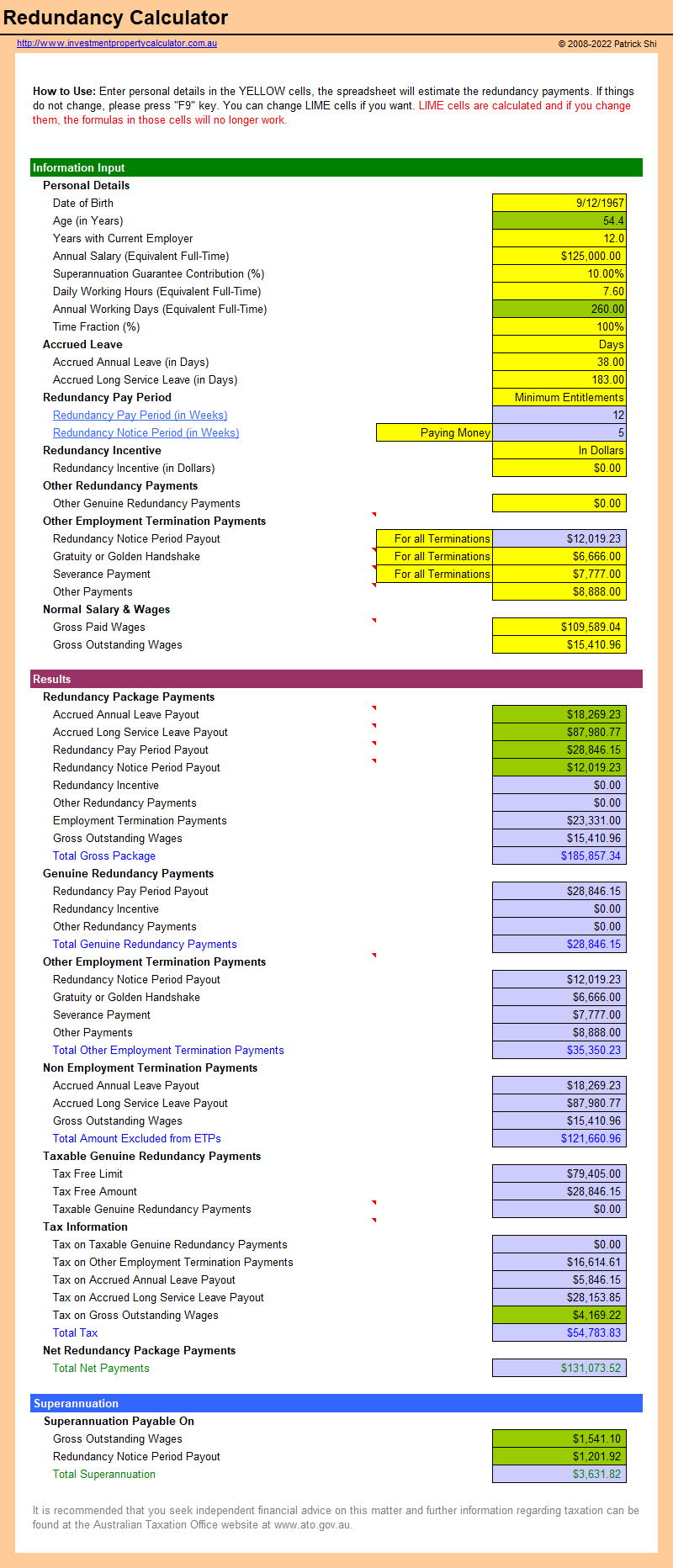

This Calculator is based on the publicly available guidelines and publications about redundancy payment that can be found in the Notice of Termination Redundancy Pay guide based on National. They are assessed as ordinary assessable income taxed at ordinary marginal rates. For any redundancy amount above a certain cap the payment is taxed at the employees typical marginal tax rate.

Redundancy payments are tax-free within certain limits and can be broadly classified into three categories- A golden handshake or gratuity A severance payment that covers a number of weeks pay for every year when you were working. Generally with concessional tax treatment the payment is taxed at a much lower rate than an employees marginal tax rate. Its reported as a lump sum in the employees income statement or PAYG payment summary individual non-business.

If your redundancy was considered genuine you should receive your genuine redundancy payment tax-free up to a limit. This Calculator is developed for Australians to estimate their possible redundancy payment entitlements tax on redundancy payout and net after tax redundancy pay.

Taxation Of Employment Termination Payments Employment And Hr Australia

When Do You Have To Pay Redundancy Sharrock Pitman Legal

Title Tax Rules On Redundancy Or Employment Termination Payments

Section B Payment Details Australian Taxation Office

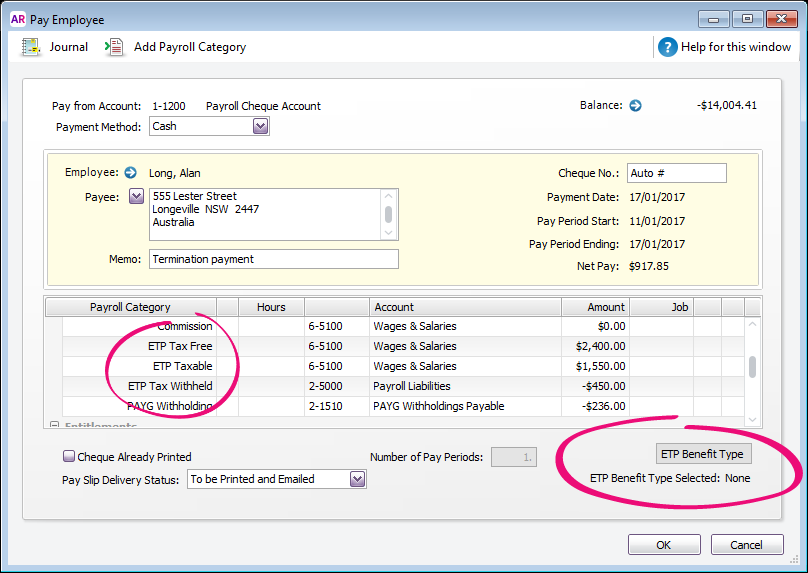

5 Record The Final Termination Pay Myob Accountright Myob Help Centre

Redundancy Pay Redundancy Entitlements Mini Guide Owen Hodge Lawyers

Post a Comment for "Tax On Redundancy Payments Australia"